montana sales tax rate on vehicles

2 A local option motor vehicle tax or flat fee is. Heggen Law Office PCs Montana RV and vehicle registration services are designed for you to avoid sales tax and high licensing fees.

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Local option motor vehicle tax.

. Montana County Vehicle Tax While Montana does not charge a state sales tax on cars counties can impose a vehicle tax depending on the value of all new vehicles trucks and SUVs. 10 Montana Highway Patrol Salary and Retention Fee. If you would like to know if a dealer is legally licensed you can email dojdealerinfomtgov or call the MVDs Vehicle Services Bureau at 406-444-3661 option 3.

There are no local taxes beyond the state rate. The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. You can learn more about licensing and distribution from the Alcoholic Beverage Control Division.

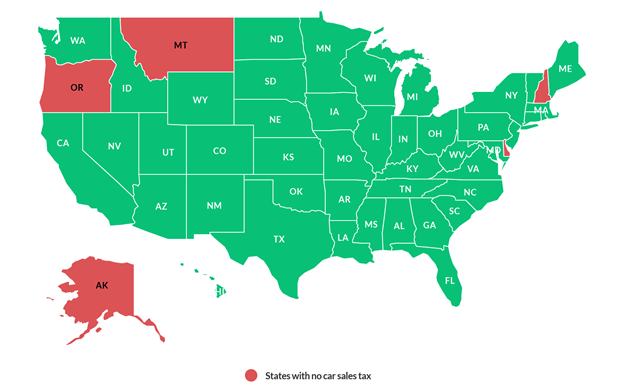

Only five states do not have statewide sales taxes. As of 2020 New York has a car tax rate of 4 plus local taxes whereas nearby Massachusetts charges 625 with some local rates even higher. Since there is no state sales tax you do not have to worry about paying any taxes on your vehicle no matter how you purchase the car.

Montana cars and trucks are exempt from sales tax in Montana MCA 61-3-311 and if you own your pickup van or car through a Montana LLC you can take advantage of permanent registration. Heggen Law Office PCs Montana RV and vehicle registration services are designed for you to avoid sales tax and high licensing fees. There are no local taxes beyond the state rate.

Distillery Excise and License Tax. Fees collected at the time of permanent registration are. County tax 9 optional state parks support certain special plate fees and for light trucks the gross vehicle weight GVW fees.

Local option motor vehicle tax. Buy From a Trustworthy Seller. Up to 25 cash back It can only work with LLCs formed in Montana because Montana is the only state which imposes no sales tax on the purchase of vehicles by its residents including resident LLCs.

We can form a Montana LLC for you including the LLC formation and initial plate registration all for a total of 849. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle.

Montana MPG 1497 Miles 14556 Average pricegallon 225 Annual Cost 2189. 1 represent either directly or indirectly that any motor vehicle advertised or sold is an executive vehicle unless the vehicle has been used exclusively by its manufacturer its distributor or a dealer for the commercial or personal use of the manufacturers subsidiarys or. The Montana State Sales Tax is collected by the merchant on all qualifying sales made within Montana State.

With more than 19 years of experience in this field we are ready to answer any questions. The Montana sales tax rate is currently. We are known for sound trustworthy advice and smart representation.

The state sales tax rate in Montana is 0000. When it comes to taxes and fees Montana is a mixed bag. The Montana State Montana sales tax is NA the same as the Montana state sales tax.

1 A county may impose a local option motor vehicle tax on motor vehicles subject to the registration fee imposed under 61-3-321 2 or 61-3-562 at a rate of up to 07 of the value determined under 61-3-503 or a local flat fee in addition to the fee imposed under 61-3-321 2 or 61-3-562. Despite living in a state without a general sales tax citizens pay a 5 rate for their car sales. For Alcoholic Beverage Taxes please select the tax type below.

It shall be an unfair or deceptive act or practice for a motor vehicle dealer to. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected. For a car purchase with no trade-in your equation would look like this for a.

If you need assistance gathering contact information call the NHTSAs Office of Vehicle Safety Compliance at 202 366-5291. Add these three tax rates together to find the total sales tax. Montana is one of the five states in the USA that have no state sales tax.

Montana is one of only four states that do not have a. Only a few counties enforce a local state tax which is why Montanas average combined sales tax rate is only 0002. Selling a vehicle in Montana can be done only through a licensed dealer or by the person whose name is on the title.

Montana has no statewide sales tax for vehicle purchases. Montana has no state sales tax and allows local governments to collect a. 2319204 MOTOR VEHICLE SALES.

For instance lets say that you want to purchase an SUV from a private owner for 30000. The Montana State Sales Tax is collected by the merchant on all qualifying sales made within Montana State. Tax Free Montana Vehicle Registration Services.

Car Sales Tax on Private Sales in Montana. Tax Free Montana Vehicle Registration Services. Montana charges no sales tax on purchases made in the state.

Knowing how much sales tax to pay when purchasing a vehicle also helps you to know when asking for financing from a lender. The state sales tax would be 0. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

You should contact the vehicles manufacturer directly. If you form a Montana LLC and have it purchase and take title to a motorhome or RV you wont owe any sales tax in Montana. The tax rate is 65 of the vehicle purchase.

Montana Vehicle Sales Tax Fees Find The Best Car Price

Oc Only 5 States Have No Sales Tax R Dataisbeautiful

Montana Vehicle Sales Tax Fees Find The Best Car Price

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What States Charge The Least Most In Car Taxes Carvana Blog

States With No Sales Tax On Cars

Is There Sales Tax On Cars In Montana

Is There Sales Tax On Cars In Montana

Is There Sales Tax On Cars In Montana

Montana Vehicle Sales Tax Fees Find The Best Car Price

Think Twice About Registering Rv In A Montana Llc Rv Tailgate Life Rv Rv For Sale Rv Life

What S The Car Sales Tax In Each State Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Is Buying A Car Tax Deductible Lendingtree

Sales Taxes In The United States Wikiwand

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

States With No Sales Tax On Cars